1

Please refer to important disclosures at the end of this report

1

1

CreditAccess Grameen Ltd (CAGL) is a Bangalore based NBFC, which is

promoted by CreditAccess Asia N.V. (“CAA”). It is focused on providing micro-

loans to women customers, predominantly in Indian rural areas. Their primary

focus is to provide income generation loans to their customers, which

comprised 87.02% of their total joint lending group (JLG) loan portfolio, as of

March 31, 2018. Company’s AUM has grown at healthy 65% CAGR over

FY2014-18 with strong asset quality (GNPA -1.97%, NNPA- NIL).

Fairly strong AUM growth at 65% CAGR over FY2014-18: Focused approach

towards micro loans to unbanked women in deep rural areas, has helped the

company to achieve a strong 65% CAGR in AUM over FY2014-18. Further, 86%

of the AUM has been lent for income generation activity.

Calibrate approach of branch expansion to propel business: CAGL’s expansion

strategy, whereby they aim to expand to the next (typically adjoining) district and

ensure deep penetration in a particular district within 3 years of commencement

of operations in the district has reaped huge benefits. As of March 31, 2018,

CAGL had 516 branches and 4,544 loan officers, with its operations being well-

diversified at the district level, with no single district contributing more than 5% to

their gross AUM.

Strong asset quality, high CAR to support growth: Robust credit assessment

process and understanding of targeted market has helped CAGL to maintain

superior asset quality (GNP 0.08% in FY17). However, due to demonetisation,

asset quality has deteriorated marginally to 1.97% (GNPA), for which 100%

provision has been accounted. As on FY18, CAR was 29% and post IPO it would

increase further. Given the strong internal capital generation ability, high CAR

and IPO proceeds, CAGL would not require equity dilution in the near term.

Outlook & Valuation: At upper end of the IPO price band, CAGL is valued at 3.8x

FY18 book value (pre-IPO) and on post dilution basis at 2.9x of BV. The strong

sponsorship of CreditAccess Asia, along with a well capitalised balance sheet and

an experienced and focused management provides an excellent base for the next

level of growth. Based on the above positive factors we assign SUBSCRIBE rating

to the issue.

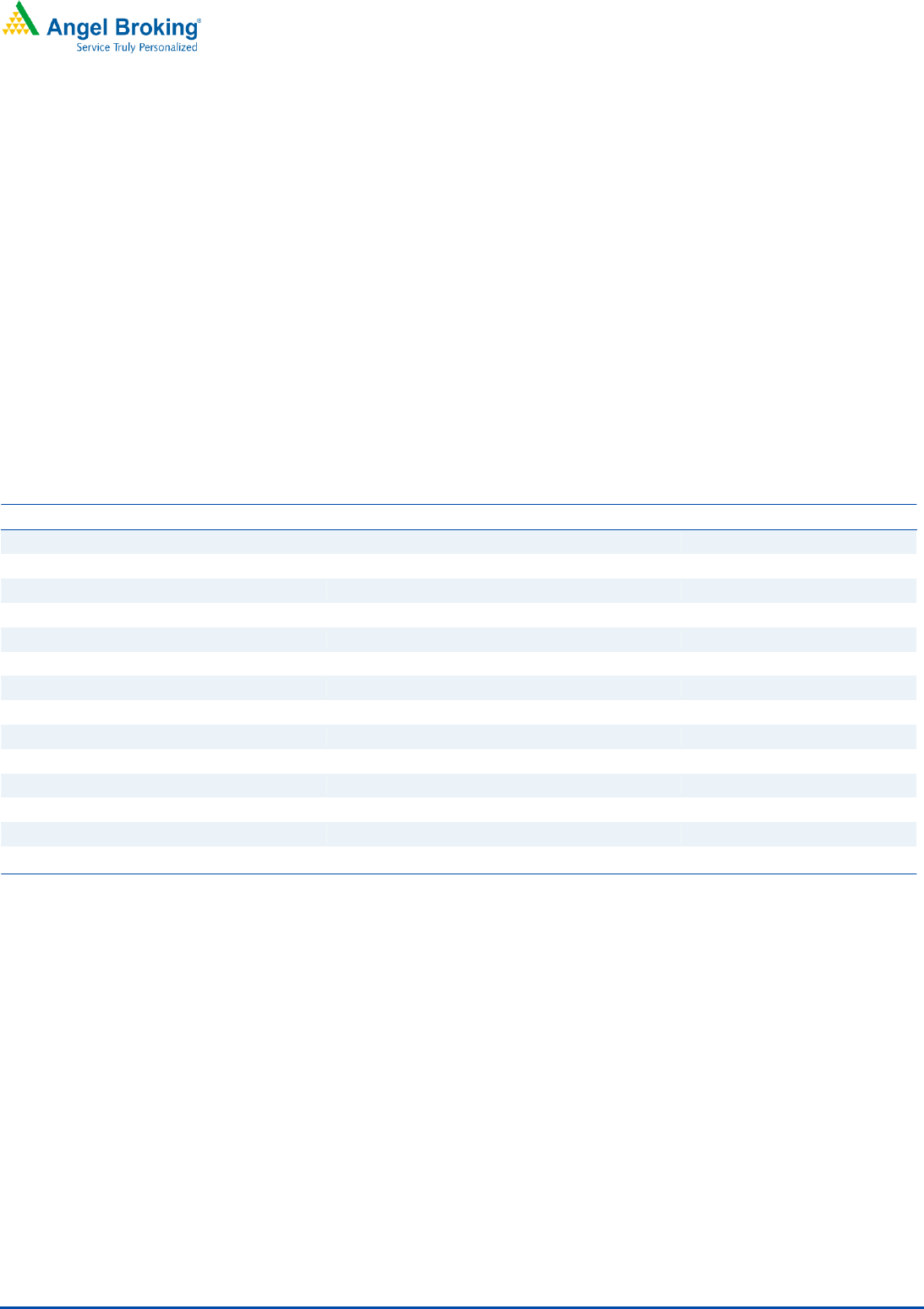

Key Financials

Y/E March (` cr)

FY14

FY15

FY16

FY17

FY18

NII

53

110

204

344

441

YoY Growth (%)

-

107

85

69

28

PAT

17

49

83

80

125

YoY Growth (%)

-

193

71

(4)

55

EPS

1

4

6

6

10

Book Value

16

29

36

54

111

P/E

326

111

65

67

43

P/BV

26

14

12

8

4

ROE (%)

8

17

20

14

12

ROA (%)

2

3

4

3

3

Source: RHP, Angel Research; Note: Valuation ratios based on pre-issue outstanding shares and at upper end of the price band

SUBSCRIBE

Issue Open: Aug 08, 2018

Issue Close: Aug 10, 2018

QIBs 50% of issue

Non-Institutional 15% of issue

Retail 35% of issue

Promoters 80.3%

Others 19.7%

Fresh issue: `630cr

Issue D etails

Face Value: `10

Present Eq. Paid up Capital: `128cr

Offer for Sale: **1.19cr Shares

P ost Issue S hare holdi ng P att er n

Post Eq. Paid up Capital: `143cr

Issue size (amount): *`1,126.4 cr -

**1,131.2 cr

Price Band: `418 - `422

Lot Size: 35 shares and in multiple

thereafter

Post-issue implied mkt. cap: *`5,992cr

- **`6,049cr

Promoters holding Pre-Issue: 98.9%

Promoters holding Post-Issue: 80.3%

*Calculated on lower price band

** Calculated on upper price band

Book Bu ilding

CreditAccess Grameen Ltd

IPO Note | Financials

Aug 06, 2018

2

Aug

06,

201

CreditAccess Grameen Ltd | IPO Note

Aug 06, 2018

2

Company Background

CreditAccess Grameen Ltd (CAGL) is a Bangalore based NBFC, which is promoted

by CreditAccess Asia N.V. (“CAA”). It is focused on providing micro-loans to

women customers, predominantly in Indian rural areas. Their primary focus is to

provide income generation loans to their customers, which comprised 87.02%

of their total joint lending group (JLG) loan portfolio, as of March 31, 2018.

Company’s AUM has grown at healthy 65% CAGR over FY2014-18 with strong

asset quality (GNPA -1.97%, NNPA- NIL).

CAGL has adopted the strategy of joint liability group model and equal

geographical distribution, which reduces risk of NPAs. It is present across 132

districts in 8 states and 1 union territory (Pondicherry) via 516 branches. None of

these locations contributes more than 5% of the gross AUM, ensuring well-

diversified distribution and lower risk

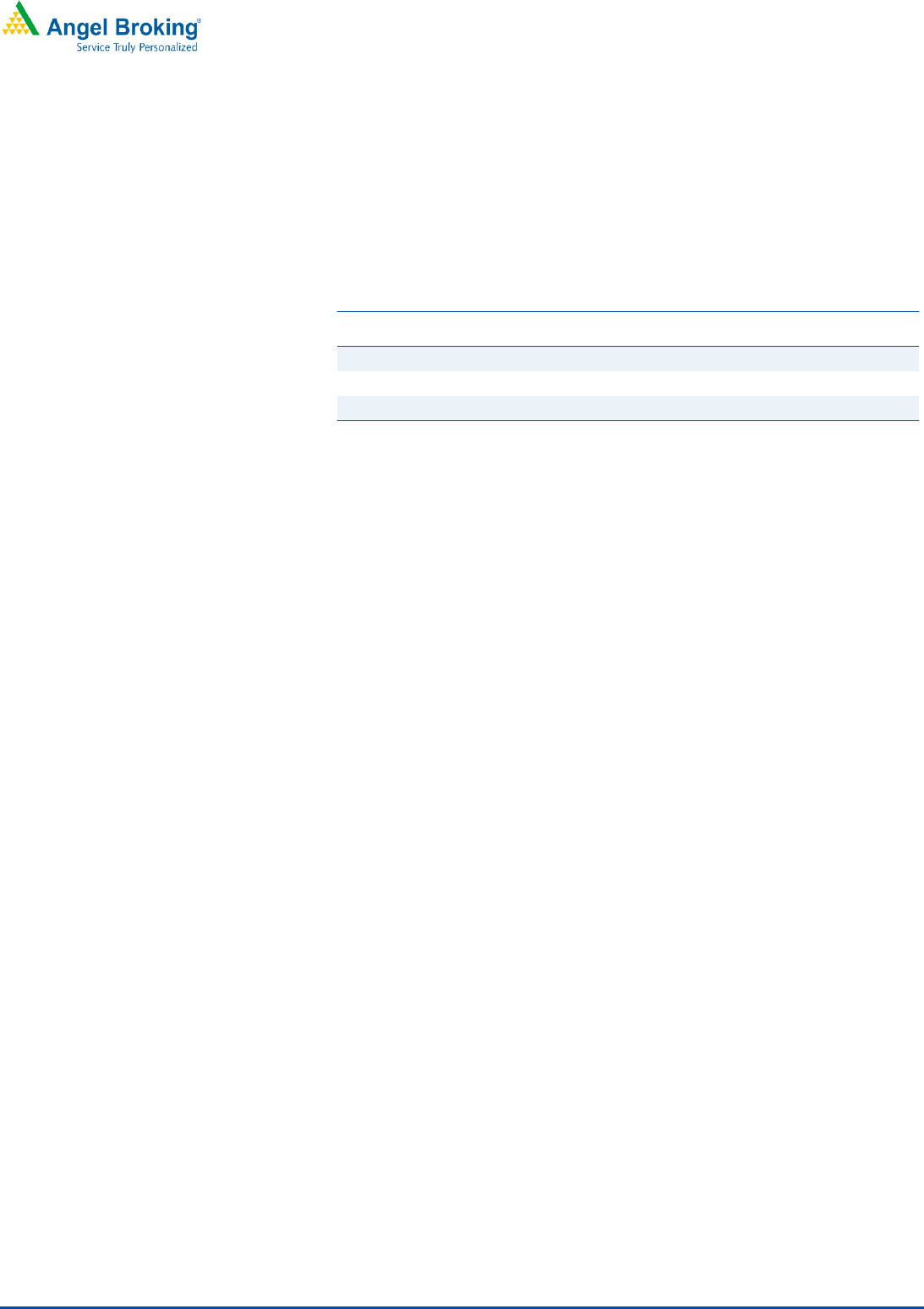

Exhibit 1: Details of the Gross AUM & Productivity ratio

Particulars (` cr)

FY14

FY15

FY16

FY17

FY18

AUM

AUM

AUM

AUM

AUM

Income Generation Products

716

1,256

2,243

2,697

4,284

Family Welfare Products

17

32

66

119

117

Home Improvement Products

63

138

212

247

520

Emergency Loan Product

13

21

18

12

2

Individual Retail Finance

-

-

-

1

51

Loan Products

-

-

-

-

-

Micro Insurance Products

-

-

-

-

-

Pension Products

-

-

-

-

-

Total AUM

809

1,447

2,539

3,075

4,974

Number of branches (Nos.)

176

238

298

393

516

Gross AUM per branch (` Cr)

4.6

6.1

8.5

7.8

9.6

Gross AUM per employee (` Cr)

0.52

0.54

0.66

0.62

0.79

Average ticket size(`)

6,086

6,660

8,201

10,887

19,671

Source: RHP

Key Management Personnel:

Udaya Kumar Hebbar is the MD & CEO of the company. He has served as the

head, commercial and banking operations at Barclays Bank PLC, Mumbai for 3

years. He also served at Corporation Bank for a period of over 10 years. He was

also associated with ICICI Bank for over 11 years.

Diwakar B.R. is the Chief Financial Officer of the company. He has 20 years of

experience in the financial services sector. Prior to joining the company, he worked

with Small Industries Development Bank of India. He was served as Chief Manager

at ICICI Bank Limited and as Commercial Supervisor at ACCION International.

Paolo Brichetti is a Nominee Director of the Promoter, CAA, in the company. He is

also the founder, chief executive officer and sole executive director of CAA since

March, 2017.

3

Aug

06,

201

CreditAccess Grameen Ltd | IPO Note

Aug 06, 2018

3

Issue details

This IPO is a mix of OFS and issue of fresh shares. The issue would constitute fresh

issue worth `630cr and OFS worth `501cr. OFS largely would offer partial exit to

investors, namely Credit access Asia N.V.

Exhibit 2: Pre and Post-IPO shareholding pattern

Particulars

No of shares

(Pre-issue)

%

No of shares

(Post-issue)

%

Promoter

12,69,85,513

99

11,51,09,028

80

Investor/Public

14,41,824

1

2,82,47,219

20

Total

12,84,27,337

100

14,33,56,247

100

Source: RHP Note: Calculated on upper price band

Objects of the offer

To achieve benefits of listing equity shares on stock exchanges and to carry out

the offer for sale. Listing of equity shares will enhance CAGL’s brand name

and provide liquidity to existing shareholders.

To augment its Tier-I capital base to meet the future capital requirements.

4

Aug

06,

201

CreditAccess Grameen Ltd | IPO Note

Aug 06, 2018

4

Outlook & Valuation

At upper end of the IPO price band, CAGL is valued at 3.8x FY18 book value (pre-

IPO) and on post dilution basis at 2.9x of BV. The strong sponsorship of

CreditAccess Asia, along with a well capitalised balance sheet and an experienced

and focused management provides an excellent base for the next level of growth.

Based on the above positive factors we assign SUBSCRIBE rating to the issue.

Risks

1. The operations are concentrated in Karnataka and Maharashtra and any

adverse sustained economic downturn and political unrest/disruption

could change repayment behaviour of the borrowers.

2. Unsecured Portfolio - CAGL’s operations involve transactions with

relatively high risk borrowers (Unsecured Loan). Any default from the

customers could adversely affect the business, operations and financial

condition.

5

Aug

06,

201

CreditAccess Grameen Ltd | IPO Note

Aug 06, 2018

5

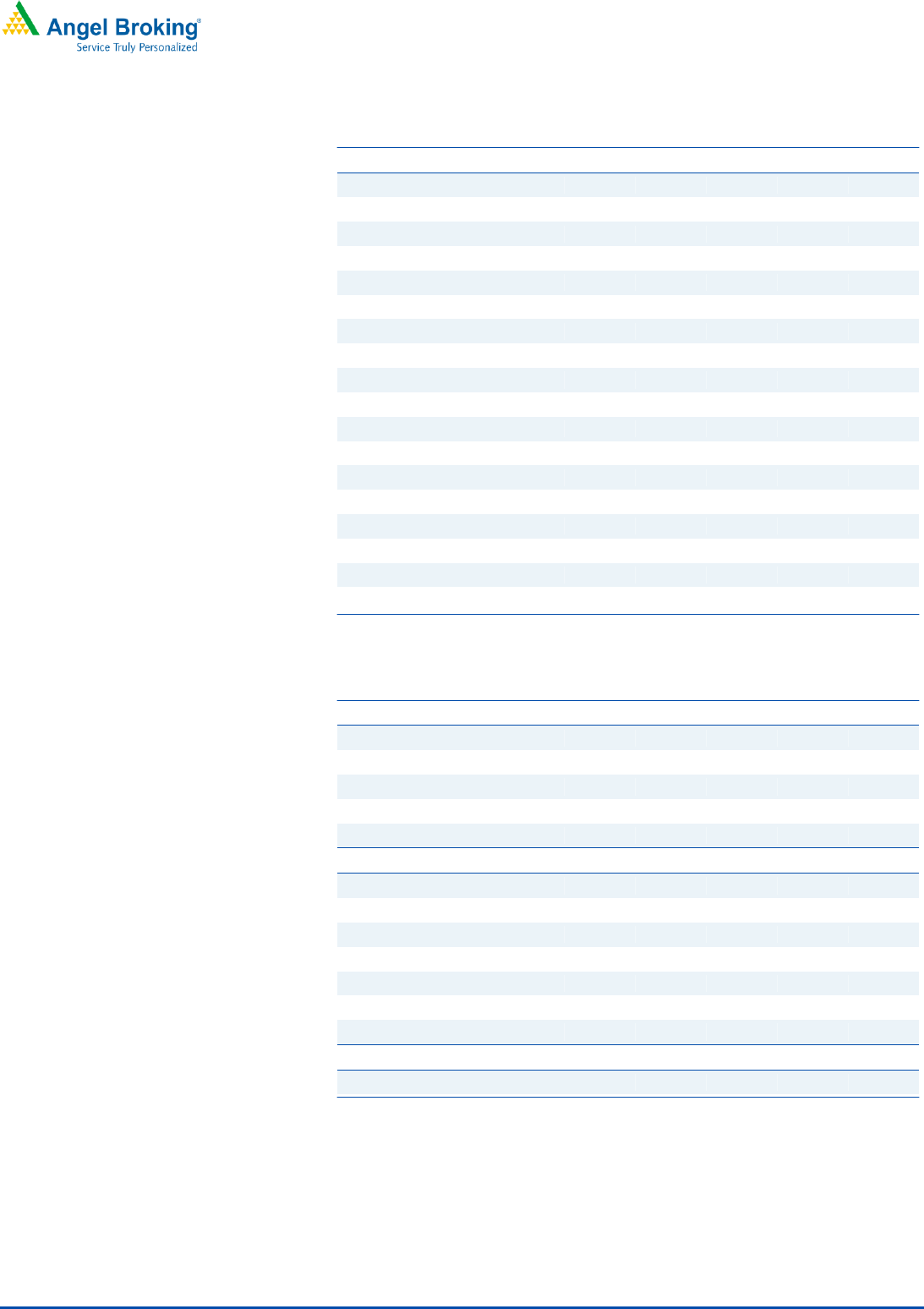

Income Statement

Y/E March (` cr)

FY14

FY15

FY16

FY17

FY18

Net Interest Income

53

110

204

344

441

- YoY Growth (%)

107

85

69

28

Other Income

22

42

54

48

80

- YoY Growth (%)

88

29

(11)

65

Operating Income

76

152

258

393

521

- YoY Growth (%)

102

70

52

33

Operating Expenses

45

71

115

160

200

- YoY Growth (%)

57

63

39

25

Pre - Provision Profit

31

82

144

233

321

- YoY Growth (%)

168

76

62

38

Prov. & Cont.

6

7

14

109

128

- YoY Growth (%)

19

105

675

18

Profit Before Tax

25

75

130

124

193

- YoY Growth (%)

202

73

(4)

55

Prov. for Taxation

8

26

46

44

68

- Tax Rate

33

35

36

35

35

PAT

16.6

48.7

83.2

80.3

124.6

- YoY Growth (%)

193

71

(4)

55

Source: Company

Balance Sheet

Y/E March (` cr)

FY14

FY15

FY16

FY17

FY18

Equity

53

73

73

86

128

Reserve & Surplus

154

303

387

605

1,299

Net worth

207

376

460

691

1,428

Borrowings

805

1,291

2,233

2,668

3,603

Other Liab. & Prov.

46

60

115

205

188

Total Liabilities

1,058

1,727

2,808

3,564

5,218

Cash Balances

325

280

255

364

138

Investments

0.20

0.20

0.20

0.20

0.20

Advances

669

1,340

2,465

3,075

4,975

- Growth (%)

100

84

25

62

Fixed Assets

3

6

11

15

17

Other Assets

58

95

65

61

53

Deffered Tax

3

6

11

48

36

Total Assets

1,058

1,727

2,808

3,564

5,218

- Growth (%)

63%

63%

27%

46%

Source: Company

6

Aug

06,

201

CreditAccess Grameen Ltd | IPO Note

Aug 06, 2018

6

Key Ratio

Y/E March (` cr)

FY14

FY15

FY16

FY17

FY18

Profitability ratios (%)

NIMs

8.0

11.0

10.7

12.4

11.0

Cost to Income Ratio

59.6

46.3

44.5

40.7

38.3

RoA

1.6

3.5

3.7

2.5

2.8

RoE

8.0

16.7

19.9

14.0

11.8

B/S ratios (%)

CAR

31.5

28.1

21.5

29.7

28.9

- Tier I

28.7

26.5

17.6

20.2

28.1

- Tier II

2.83

1.58

3.88

9.50

0.87

Asset Quality (%)

Gross NPAs

0.01

0.04

0.08

0.08

1.97

Gross NPAs (` cr)

0.1

0.5

2.0

2.6

98.1

Net NPAs

-

-

-

-

-

Net NPAs (` cr)

-

-

-

-

-

Credit Cost on Advance

0.71

0.47

0.55

3.53

2.58

Provision Coverage

100%

100%

100%

100%

100%

Per Share Data (`)

EPS

1

4

6

6

10

BV

16

29

36

54

111

ABVPS (75% cover.)

16

29

36

54

111

DPS

-

-

-

-

-

Valuation Ratios

PER (x)

326

111.2

65.1

67.5

43.5

P/BV (x)

26.1

14.4

11.8

7.8

3.8

P/ABVPS (x)

26.1

14.4

11.8

7.8

3.8

Dividend Yield (%)

-

-

-

-

-

Source: Company

7

Aug

06,

201

CreditAccess Grameen Ltd | IPO Note

Aug 06, 2018

7

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National

Commodity & Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and

Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered

entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164.

Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities

Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public offering of securities of

the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.